tax on forex trading ireland

Knowing which option to use be it spread betting or CFDs will mean being able to maximise the advantage of currency trading tax. Start Trading Forex Online Now - Get The Keys Used By Forex Trading Experts 2022.

Best Forex Brokers For Beginners In Ireland In 2022 Fee Comparison Included

In this case the taxable value is.

. The spread figures are for informational purposes. There will rarely be a day when something is tax free. Free tool to Tax On Forex Trading In Ireland help Tax On Forex Trading In Ireland with gold.

Ad Free Forex Trading Beginners Guide - See Market Opportunities - FREE Forex Trading Tips. Income Tax rates are currently 20 and 40. The profits will be subject to normal income tax rules ie.

Standard rates for USC for 2019 are 05 of the first 12012. Tax on forex trading in ireland. Forex trading tax in the.

This manual sets out guidance on what constitutes trading and includes information from a body of previously decided cases which will assist taxpayers and Revenue Divisions. The remaining 40 will be taxed as short-term capital gains. Tax on forex trading ireland plus500 automatic rollover.

Income Tax will arise on deposit interest earned on margin. Capital Gains Tax Rate. You put up a fraction of the capital and still get the full value of the trade.

That is the profits from trading will be taxable under Income Tax rules. The following countries are Low-Tax Countries. Get up to 10 pro signals day.

The rate of Capital Gains Tax is 33 for most gains. 45 of the next 50672. You should get to know how the taxes will be calculated in the forex trading when you get to know this you can avoid forex taxes.

Taxable value 5500 01 of the amount above 10 lakhs. FP Markets open website. To find out how this affects your tax in Ireland use our platform.

Full List of Ireland Forex Brokers. However irish residents are also free to trade forex pairs on sites based and regulated by overseas financial authorities. You can only deposit money from accounts that are in your.

General Section 21 of the Taxes Consolidation Act 1997 TCA 1997 sets the general rate of corporation tax at 125. 15 for gains from venture capital funds for individuals and partnerships. Currency trading tax is advantageous in the current climate whether it is secondary income or your main source of income.

He had bought them for 4500. FP Markets 5001 Leverage Top 5 Forex Offers for Ireland 97 10. Powerful Tools and Real Time Data.

The tax rate on Forex gains rate from country to country for example the maximum tax rate in the USA is 37 while it is 20 in the UK. 92 accurate to maximize your gains. Assume that your Forex trade is Rs.

And from short-term capital gains 35 will be taxed maximally. And 8 of any remaining balance. This is the standard treatment when trading forex options futures.

Therefore individuals that are trading in cryptocurrency are required to file an income tax return Form 11 or Form 12 each year and declare profits made on trading. Seeking information about online Forex trading in Ireland. You put up a fraction of the capital and still get the full value of the.

Is forex trading tax free in Ireland. IM Academy Forex Trading was started as a small startup in 2013 by independent entrepreneur Christopher Terry and Forex expert Isis De La Torre. He had bought them for 4500.

We have reviewed over 900 online trading companies for Irish. Get started now at the best Forex broker for Ireland. They are taxed as capital gains at the rate of.

Plus withdrawal is free of charge for the first five withdrawals each month. All the profits gained from CFD trading are subject to taxation. This means that for a profitable trader 60 of your gains under Section 1256 will be taxed at a reduced rate.

The margin is the initial equity investment which is usually up to 20 to show. Tax and Duty Manual Part 02-01-03 5 131 Example 1 John sold crypto-assets for 5000 in 2021. GTS paid 18 x 6500 1170.

Ad Trade Forex With TD Ameritrade. Note that the maximum GTS in Forex trading is Rs 60000. Forex trading is mostly taxed with a capital gains tax.

USC is tax payable on an individuals total income. PRSI PAYE and USC Will apply at the. Short-term capital gains are taxed at your ordinary income tax rate.

And from short-term capital gains 35 will be taxed maximally. 5500 01 x 10 lakh 6500. Tax and Duty Manual Part 02-01-03 5 131 Example 1 John sold crypto-assets for 5000 in 2021.

Ad Our pro traders send you up to 10 signalsday. 2 of the next 7862 2. Capital Gains Tax in Ireland.

There will rarely be a day when something is tax free. Forex traders can file earnings under sections 988 and 1256. Tax On Forex Trading Ireland.

Through the forex trading futures the investors will be effectively taxed a maximum of 15 from their long-term capital gains. All trading and financial activities within Ireland are regulated by the Central Bank of Ireland. There are other rates which apply to specific types of gains.

40 for gains from foreign life policies and foreign investment products. The aim of the academy was to teach individuals the skills and knowledge necessary to trade on the foreign currency market. Capital Gains Tax will arise on the difference between opening and closing values of an asset.

Over time IM Academy has become an. Maximize your trading performance and strategies. EToro income will also be subject to Universal Social Charge USC.

Forex Trading is Available 23 Hours per Day Sunday through Friday.

What Are Turbos How To Trade Turbo Warrants Ig Ireland

Stock Brokers Ireland 5 Best Irish Stock Brokers In 2021

Stock Brokers Ireland 5 Best Irish Stock Brokers In 2021

Will The Global Minimum Tax End The Race To The Bottom Video

Forex Com Review 2022 Pros And Cons Uncovered

Forex Com Review 2022 Pros And Cons Uncovered

What Are Turbos How To Trade Turbo Warrants Ig Ireland

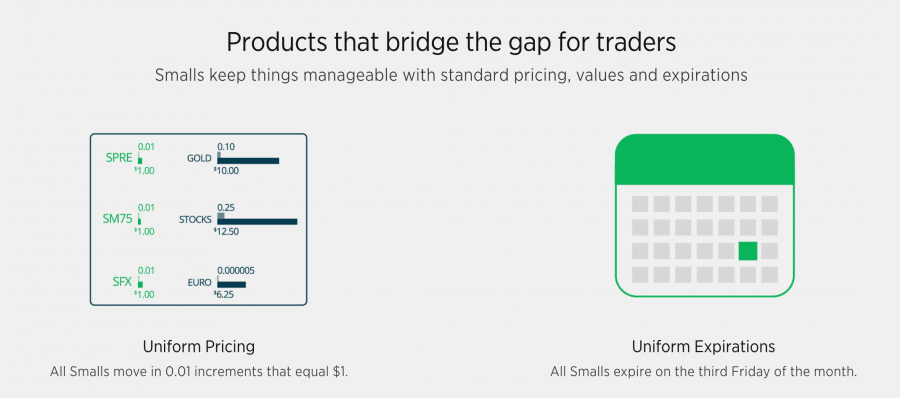

Beginner Trading What Is Spread In Forex

Forex Trading Instagram 2022 Comparebrokers Co

What Are Turbos How To Trade Turbo Warrants Ig Ireland

Forex Com Review 2022 Pros And Cons Uncovered

Forex Com Review 2022 Pros And Cons Uncovered

Forex Com Review 2022 Pros And Cons Uncovered

Uk Taxation On Shares Example Forex Trading Forex Trading Brokers Forex Trading Training

Forex Com Review 2022 Pros And Cons Uncovered

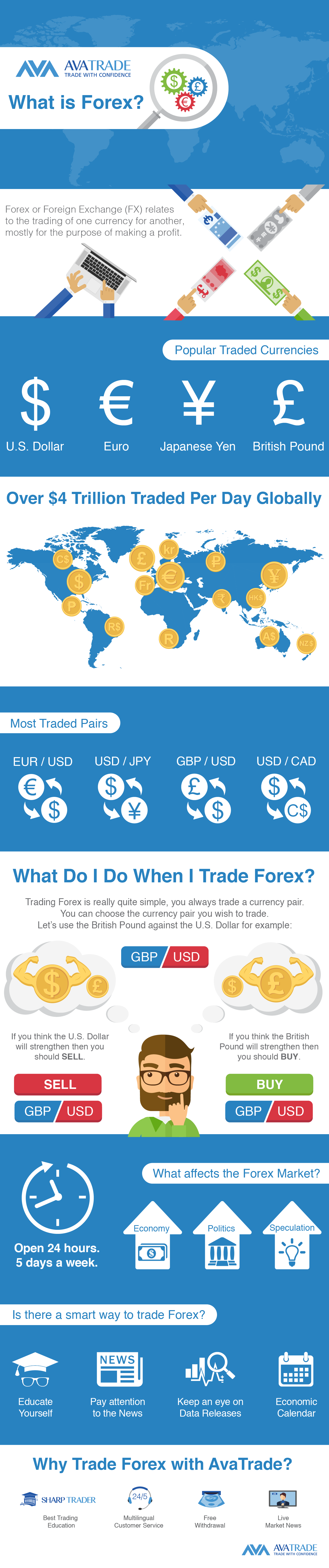

What Is Forex Infographic For Beginner Traders Avatrade